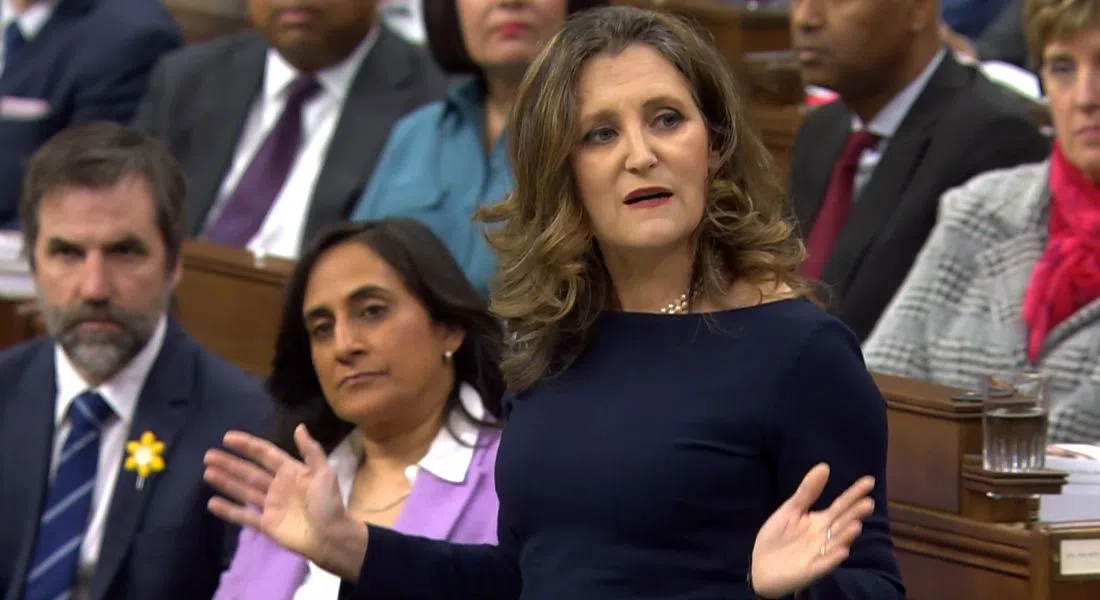

Finance Minister Chrystia Freeland tabled the federal budget in the House of Commons this afternoon (Tues) which she says checks all the boxes from their goals of maintaining the deficit at or below $40.1 billion, lowering the debt-to-GDP ratio in this fiscal year, then keeping it on a declining track after that, and keeping deficits below one per cent of GDP in 2026-27 and future years. She stresses that every single objective is being met. “As is our fiscal anchor – a declining federal debt-to-GDP ratio over the medium term. In fact, Canada has the lowest deficit and net debt-to-GDP ratios in the G7, as recognized in our Triple A credit rating.”

In general terms, she says the budget ensures fairness for every generation, helping to build more homes faster and making life cost less through things like $10 a day childcare, a new school food program, and a pharmacare program, but it also makes the tax system fairer by having the wealthiest 0.13 per cent pay more. As well, Freeland announced that the Canada Carbon Rebate for small businesses will return over $2.5 billion directly to about 600,000 small and medium sized businesses, which is something the Canadian Federation of Independent Business has been calling for.

The Finance Minister also highlighted that for first-time home buyers, the federal government will extend the maximum amortization period of a moorage to 30 years on new builds. On the other hand, for the wealthiest Canadians, the top 0.13 per cent, Freeland says they will be paying more tax, making the tax system more fair.

The $39.8 billion deficit is just under the $40.1 billion projection from the fall economic statement. Freeland has set a budget goal of reducing the annual deficit to $20.8 billion dollars in five years. In an effort to cut costs, the federal workforce will shrink by about 5,000 full-time employees over the next four years.

Some key highlights for 2024-25 include the first programs to cover contraceptives and diabetes medication and supplies. This is part of the government’s new pharmacare plan, and it is expected to cost $1.5 billion over five years.

High-worth individuals, corporations and trusts will pay more in capital gains taxes. Excise taxes on tobacco and vaping products are rising; $4 a carton of cigarettes and by 12 percent on vape supplies. The government estimate that will generate nearly $1.7 billion in revenue over five years.

In hopes of building nearly 3.9 million homes by 2031, the government plans to increase the capital cost allowance rate for apartments from four to 10 per cent, allowing builders larger tax write-offs. About $250 million will be spent over two years to address the shortage of shelter space for homeless people.

When it comes to taking care of student debt, the government will spend $48 million over four years and $15.8 million thereafter to forgive the loans of early childhood educators.

In foreign policy and defense, the Liberal government plans to boost military spending to 1.76 per cent of GDP by 2030 and spend $1.6 billion over five years for lethal and non-lethal military aid for Ukraine.